You may have noticed a recent uptick in prices for homeowners and auto insurance. Key factors driving the rate increases include:

Extreme Weather Events and Catastrophes

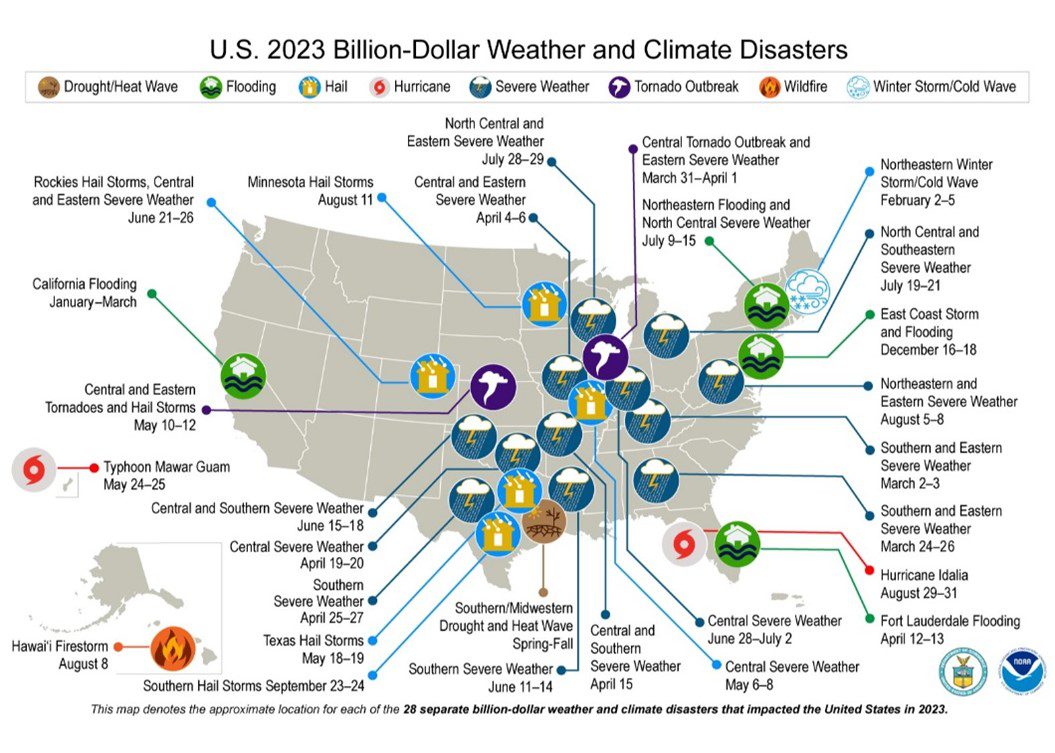

- The U.S. was struck by a historic 28 separate billion-dollar weather related disasters in 2023. While many of these storms didn’t make national headlines, they did have a very costly impact at the local level. The breadth of geographic areas where these storms are happening, well outside the usual California and Florida events, is concerning.

Rising Material Costs

- Property

- Increased cost of material and property values increasing

- Auto

- Supply chain disruption and increased costs of parts

- Inflation is also still driving up material costs

Continued Availability Constraints

- Carriers may scale back in or exit entirely certain regions most susceptible to natural disasters. Re-assessment of those risk areas will likely happen throughout the year (leading to 6-month vs. 12-month renewals).

What Can You Do?

Current market conditions impacting your insurance premiums may be out of your control, but you can take some steps to keep the cost of your coverage in check.

- Bundle your policies: Carriers often offer discounts if you have more than one policy with them.

- Increase your deductible: Higher deductibles will likely reduce your premium.

- Review your insurance: Ask your agent to review all of your policies. Make sure renovations and new vehicles are included. Cancel or reduce coverage you no longer need.

- Install protective devices: Some carriers offer discounts for smoke detectors, fire alarms, water sensors, interior sprinkler systems and smart home protection devices.